FRONTLINING CURRENCY

:

“Speculative Numismatics” as Antagonistic Graphic Design

by Chris Lee

The moment goldsmiths began issuing banknotes, they became history’s most powerful graphic designers. This essay is about conflating (de)sign with currency in order to implicate graphic design’s political dimension and to call out the critical potential of alternative currencies.

It is difficult to make general claims about what alternative currencies are for and what they are against if, we were to see them as an antagonistic/political phenomenon. However, while efforts around alternative currencies follow a range of motivations from militant regionalism to eco-lifestyle projects, the very gesture of attempting to institute an alternative plays out at least as a direct challenge to the assumed opacity of monetary hegemony. As a graphic designer, I am interested in modelling the possibility of alternative currencies as an antagonistic graphic design practice by observing how power is channelled through signs like currency. Avoiding the occasional tendency for discussions around alternative currencies to slide into reactionary discourses like Tea Party-style libertarianism or fully degenerate anti-semitism that one can come across online, I approach the subject via graphic design and consider alternative currencies in light of their critical and transformative capacities. I believe that what the discourse around alternative currency sorely needs is a heavy dose of critical and utopian speculation—images, visualizations, performances, sounds, maps, plans and so on, as an “investment” (let’s not be afraid of these words) in what Félix Guattari calls “many alternative set-ups.”1 What’s needed at the same time is an intensification of discourse around the dissident and transformative potential of graphic design.

fig. 1 Exodus trade note

Exchangeable for 4 euros at the Dutch chain shop HEMA, within 30 days from the date of “issue.” This note is backed by a bucket of 100 color markers. An experiment in temporarily amplifying the circulation of value and considering the operation of legitimacy.

This article can also be read as an effort towards bringing numismatics (the study or collection of currency, including coins, tokens, paper money, and related objects)2 outside the realm of peculiar hobby, to propose “speculative numismatics” as a genre of graphic design.3 That is, the imagination of other social-political/monetary realities through speculative visualizations—an aesthetic tactic in the struggle against state and capital,4 by opening up another front along the lines of monetary contestation, a struggle over the space of signs and their legitimization.

The basic premise here is to consider alternative currency programs as graphic design praxis that “frontlines,” or renders the representation of value, as a space of contestation. This is not to inflate the valorisation of graphic design as a professional category, but rather to situate it as an aesthetic praxis engaged in the production and antagonism of signs, under the premise that signs are channels of force that circulate and thereby reify power. One could claim that among other things, graphic design is implicated in processes of naturalization of discourse through formalizing, standardizing, institutionalizing and legitimizing signs, or in other words, making koine5 the power that backs the meaning of signs (which I will henceforth use interchangeably with the term discursive standards). What is at stake in the recognition of money as a naturalized discursive standard is the possibility of challenging its naturalized legitimacy through formal/aesthetic praxis.

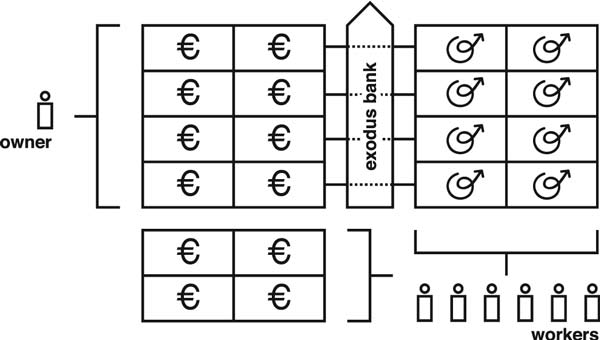

fig 2. Exodus Banking Initiative:

the “exodus bank "(re)presents value by estimating the surplus value collected by the owner(s) of company “x,” then counting towards the “exodus bank-” accounts of the workers of the same amount in “exodus bucks.” Initially these units may not be spendable, but with the incubation of a sufficiently complex network of worker/prosumers—holding accounts with local branches of the “bank”—the “exodus” currency system may be launched and notes emitted to render redundant the artificially scarce fiat-currency, thereby instituting a currency representing labour rather than capital.

The seemingly inevitable ontology of money has largely remained outside the stage of political contestation, marking an under-explored channel for significant critical and material contributions to struggles for social and economic justice. According to geographer Peter North in his book “Money and Liberation: The Micro-politics of Alternative Currencies,” even Marx glossed over the question of money in Das Kapital, considering the commodity money of his time (gold), to be the ultimate form on which to hinge his analysis.6 However, doing so largely neglected the possibility of imagining and struggling for other monetary realities and their attendant political-economic configurations.

“When we are talking 'de signum,’ about signs, we have to point out that signs are born out of conflict.”

—Société Réaliste, in the exhibition guide for Pre-specifics: Access X!

Thus, to create new signs and spawn new social realities, a site of conflict needs to be located. I believe here we have to start with the question of legitimacy: What is it that makes the dollar function as money, but not the I.O.U. I tried to give at the supermarket? It doesn’t take much reasoning to conclude that if I were sufficiently threatening, the supermarket could agree that my I.O.U. is legitimate. Most people who are sufficiently threatened will accept any ridiculous claim as reality. The dollar’s legitimacy, for example, is guaranteed primarily because at one moment or another, it is the sign which the state (with its monopoly on coercion and subsequent capacity to define reality) demands through taxation as a reification of its hegemony. It is thus incumbent on all economic actors under the domain and protection of the state, to adopt the logic of the state, and subsequently demand whatever it demands in taxes. In essence, taxation not only sustains the sovereign, but insists that we all become little kings and queens ourselves. While the state establishes itself through the enclosure of the commons and creating an interdependency on the basis of the subject’s insecurity, the subject establish her ‘sovereignty’ by limiting the exchange of her social capacities, i.e. labour power. Sometimes this labour power becomes very cheap, or basically worthless by being very common, forcing some people to establish their ‘sovereignty’ the way it was originally done. I am not suggesting however that ‘sovereignty,’ state or other, can stamp out the deficiencies of markets. In an article for Mute Magazine, and much more substantially in his recently released book, “Debt: The First 5,000 Years,” anthropologist David Graeber debunks the myth (among others) of the diametrical opposition between states and markets and argues that in fact, they are two sides of the same coin.

fig. 3. Bank Robbers steal from some people so they can pay others.

It begins with the debt-logic of slavery and leads to the debt-logic of taxation as the catalyst of markets. He suggests that the coercive condition of slavery is one where all debts (obligations) that were owed previous to one becoming a slave are negated, and all that remains is the ostensibly absolute debt to one’s conqueror. The reason for this ostensibility is that a defining feature of slavery is that slaves can be bought and sold, making the debt quantifiable. The primary consequence of this was that debt made it possible to formulate our modern understanding of money, and that it produced as a result the “...market: an arena where anything [could] be bought or sold, because all objects are (like slaves) disembodied from their former social relations and exist only in relation to money.”7

He elaborates on the parallel between the debt to the dominating slave-master and the debt to the sovereign with its monopoly on violence. In the instance of gold, which had by some process, been found to be sufficiently acceptable as a universal discursive standard on the market of commodities—once it became money—it was those political actors with the capacity and means to exert force (to mobilize the resources to obtain gold through extraction [getting people to go into the ground for you] or conquest [getting people to kill for you]) who capitalized on this condition.

The acquired gold would be “emitted” onto the subject population, through spending, particularly to raise and maintain a regular army. For sovereigns, the encouragement and maintenance of markets, argues Graeber, was more convenient than having to regularly levy whatever was needed. Essentially, sovereigns maintained regular armies with payment in coin, and then demanded the same coins through taxation from the subjugated population. This population was consequently compelled to tailor their production and establish markets to service the army and to obtain the coin to pay the sovereign’s tax. What emerged was a kind of legitimate extortion racket—a structural relation of domination mediated by money (the discipline of the state being distributed through economic activity) and consequently, a conceptual enclosure on the legitimate representation of value.

fig. 4. Military-coinage-complex: state and market emerge as two sides of the same coin. The sovereign issues payment to soldiers in a form that can retain its value over distance and time (i.e. gold). the sovereign subsequently demands the same form of payment through taxation (enforced by the soldiers), from the population under its domain, thereby systematically incentivizing the service of soldiers and the consequent emergence of markets.

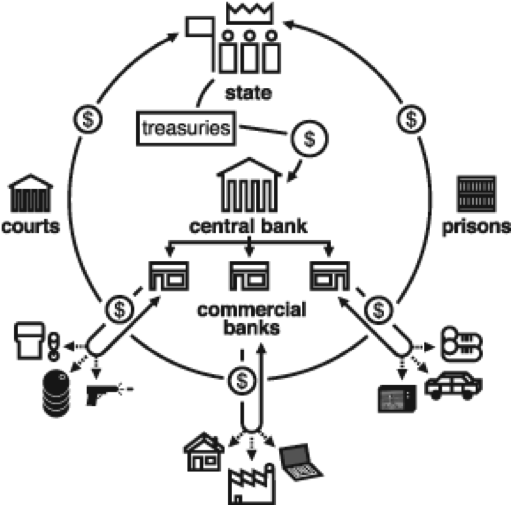

fig. 5. Central banking system

$100 is created when the central bank purchases a $100 in treasuries. this is essentially a loan to the state, which guarantees repayment through its capacity to carry out sufficient taxation. this loan carries an extra load of interest which is passed down when the money is then distributed to commercial banks who make it available through loans. this generates an imperative for perpetual growth and expansion, since the actual money supply is necessarily lower than what is ultimately owed to creditors. (see also fig. 7–9) consequently the privileged activities are those that will be more likely to produce profit, eternally. unfortunately, this diagram doesn’t even begin to broach the obscenity of fractional reserve banking.

fig. 6. An “educational-industrial-complex” scenario sketch

what if currency were issued from an institution like a school. what kind of production and production relations does this incentivize and generate, and how? would curriculum become, in effect a direct articulation of economic policy? could this be more transparent than banking? could our current idea of what a school is become an anachronism? what could such a “school” look like?

This opens up a further parallel between sovereigns with their enclosure of the commons and that of fractional reserve system of central banks. Such a banking system, which creates money through interest-bearing loans to the state, has usurped the capacity to emit money and left the state kicking in its own head to come up with the cash to pay off its debt to itself. Instead of markets existing to support soldiers, they now exist to serve banks and support an unsustainable perpetual growth imperative generated by usury. If goldsmiths became graphic designers, here bankers became a kind of financial avant-garde, carrying out a non-violent revolution and enclosing the common capacity to represent value behind a technocratic wall of inflation/deflation, adjusting interest rates on a flawed money system—when bankers say “jump!” we say “how high?” Democratically unaccountable central banks thus maintain an exclusive handle on the money faucet and perpetuate the paternalistic and violent logic of enclosure, exclusion and the maintenance of insecurity.

fig. 7. Commercial banks create money based on their holdings with the central bank. money is created as an account balance when a loan is issued. these loans carry an extra burden of interest.

fig. 8. The absolute obligation to repay principal and interest means that someone defaulting is an inevitabiliy, since the amount of money in circulation is insufficient to meet everyone’s obligations. fortunately, there is a broader network of borrowers who have also taken out loans, making available a larger money supply.

fig. 9. Unforunately, the overall insufficiency of the money supply remains, perpetuating a compulsion to exploit and marginalize others to avoid one’s own insolvency.

One may wonder why a population sufficiently organized could not institute a legitimate non-state, non-centralized (in terms of control and governance) alternative, or why these efforts are not more wide-spread, particularly if we consider currency to be primarily a form of information (rather than value)—what hinders people from representing information and a mutual recognition of its legitimacy? Why do we concede to the inevitability of our current form of hegemonic money? In response, I propose looking at the notion of “network power.” Even without the coercive power of the state, currencies, can also be backed by the potential of marginalization if one does not comply with, or refuses a currency’s “network power.” I refer to the way the idea was developed in “Network Power: The Social Dynamics of Globalization” by David Grewal. For Grewal, the concept of the standard is pivotal to understanding the power dynamics of networks. Standards are the things that coordinate and facilitate sociability (languages, protocols, acceptable behaviours, currencies, etc.) and generate a kind of “social gravity.”

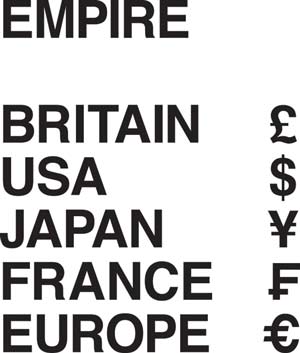

fig. 10. Empire. These are the main currency symbols available in most fonts.

Taking for example, a standard like the English language, one can easily grasp that a significant degree of it’s practical hegemony comes simply from the fact that because more people speak English, it becomes exponentially more compelling to learn the language in order to socialize and co-operate with others in a given network. At first this seems obvious and beneficial. But as the “gravity” of a standard intensifies, and agents are compelled, for no other reason than that the viability of alternatives diminishes (or that switching to an alternative standard becomes too costly) the hegemony of a standard, it’s status as koine (with, for instance, its inherent conceptual limitations and biases), can start to resemble conditions of imprisonment.8

The problem of this condition is palpable particularly when we consider that the difference between the yen, the dollar or the euro is characteristic of the “narcissism of small differences,” and that they all belong fundamentally to the same hegemonic category of money. To reiterate, all official, fiat currencies in circulation today created through central banks (which in many cases such as the United States and the Federal Reserve Bank, are ostensibly state institutions, but for all intents and purposes actually private enterprises).9

The naturalized imperative for perpetual growth and accumulation, and its attendant practices of competition and exploitation, are motivated further by the threat of social-economic marginalization (poverty) resulting from non-compliance with a network standard. All economic actors, from owners to workers, are thus equally implicated in the continued use of a standard of exchange which compels them to struggle against each other. It remains a stubborn fact however, that the stronger incentive for those closer to marginality, to desire, demand and develop alternatives to such an asymmetrical situation. To advocates of alternative currencies, the great error is the use of commodity money—an ideal form for the hoarding of wealth—as currency which in its ideal form facilitates the circulation of wealth.

Designing resistance, exodus

Escape from this situation would constitute nothing short of an “exodus,” and would require a (re-)presentation of value as a reification of a different, hopefully democratic source of legitimacy. One may take up the argument that capitalism’s essential operation lies in a matrix of the maintenance of scarcity, with its attendant intensification of insecurity and imperative to accumulate and grow. The potential of reterritorializing the struggle against capital from the field of class antagonism to what Richard Day might call a “non-hegemonic” contest over standards presents itself. The “non-hegemonic” posture Day illuminates in his book “Gramsci is Dead: Anarchist Currents in the Newest Social Movements,” manifests as a radical challenge to the “hegemony of hegemony.” For example, Day points out that radical indigenous politics in North America does not only seek self-governance, but also to challenge the “...European notion of sovereignty upon which the system [of] states is constructed.”10 Similarly, alternative currencies are not necessarily efforts aimed at annihilating the hegemony of commodity-money and replacing it with another hegemonic money, but rather challenge radically what (and how) money can be, bypassing the anxiety and stalemate of an insurmountable condition and raising the possibility of a plurality of “minor monies.”

One could also be utterly pragmatic and populistic and simply ask why the absence of “official” currency should cause stagnation when there are what North calls economically ‘sub-altern’ groups with the capacity and will to work, and others that need work done?

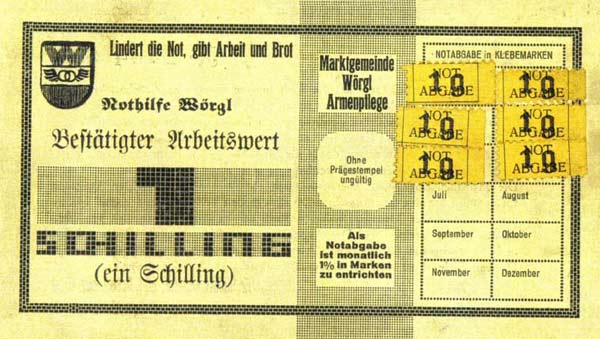

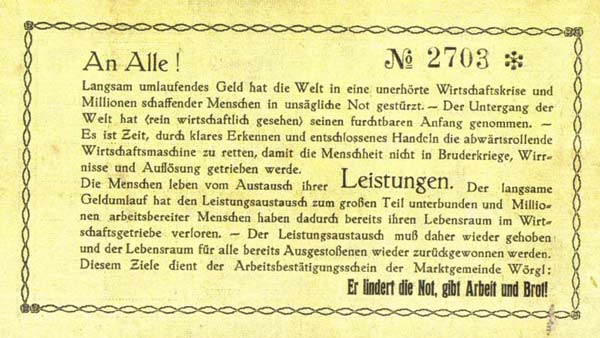

fig. 11. Front and back-side of the Wörgl labour note.

The case of Wörgl, Austria in the mid 30s is illustrative. Based on the ideas of Silvio Gesell, the mayor of this town, Michael Unterguggenberger, implemented a “demurrage” currency, which was designed to lose value over time in a process of “reversed-interest” so that it “decayed” like other natural commodities. The perhaps cumbersome design feature of adding stamps to the “labour notes” every month represented a note’s decrease in value. This feature deincentivized hoarding and accelerated the velocity of circulation. Being valid only in Wörgl and a neighbouring village, 12,000 schillings of labour note wages facilitated the production of over 100,000 schillings in public works. The town enjoyed the status of being an oasis of economic activity in the midst of the Great Depression.11

In effect, the official fiat currency, which had seen tightened circulation was made redundant, and in many ways the new currency challenged the legitimacy of the national state. It represented a challenge to what Peter North, invoking Foucault, understands as a local system of domination, “...in which we are trapped but which we also resist.” (North, 33.) It brings to light the perception of currency as a (constructed) structuring discourse which can be challenged with “micro-political technologies.” (37)

“The effects of power are everywhere, but, consequently, so is resistance to it. But this resistance is in the form not of one “great refusal, no soul of revolt, source of all rebellions.” Rather, there is “a plurality of resistances, each of them a special case: resistances that are possible, necessary, improbable; others that are savage, solitary, concerted, rampant, or violent; still others that are quick to compromise, interested, or sacrificial” [Foucault 1998, 96].” quoted by North, (p.34, North)

The alternative currency movement could be read tentatively as an “affinity” network of non-hegemonic heterotopian endeavours,12 to the extent that alternative currency programs for the most part appear to address the “gaps” of the formal economy. They tend not to emerge from the analyses of classic marxist or anarchist struggles and as far as I can tell do not strive for revolutionary annihilation of the standing hegemony. For some radicals and militants, this may be disappointing, and in some kind of final analysis, come off as apolitical and complacent. I would argue however that their subversiveness is to be found in the pluralization of the space of exchange and “...illuminate[s] local power circulations and are an affective means of local struggle against this local power... They may be one of Guattari and Negri’s ‘thousand machines of art, life and solidarity.’” (p.39, North). They render the space of exchange standards agonistic, but bypass a hopeless stalemate of hegemonies.

This is not to say that ultimately, alternative currency schemes remain at the level of symbolic representative gestures. I would emphasize the opposite—the potential for a plethora of alternative currency systems to actualize the autonomist “exodus” is staggering. Operating as an informal, decentralized and non-hegemonic “affinity” network, they would render redundant, as a thousand local machines, the hegemonic discursive standard, re-channeling—re-weaving—the warp and weft of the economic fabric of “empire,” to the point that it’s collapse means devastation only for those fully invested and insistent on fiat money’s hegemonic configuration of reality. Here lies its properly antagonistic dimension. The potential critical moment here is the one when debt-obligations to unaccountable financial institutions go the way of the emperor’s new clothes, which rather than being a great moment of refusal that reifies hegemonic dominance, ultimately disempowers the interests and institutions of the current koine. However, the problem of legitimacy persists. One urgent challenge of graphic design is then to consider how to account for the question of legitimacy—i.e. yes, we can design an I.D. card, but the design only ‘functions’ if there is someone to ‘punish’ those without one...

Far be it for me to suggest that “speculative numismatics” and alternative currencies, as a forms of monetary contestation necessarily represent an overlooked and definitive anti-capitalist silver bullet. My intention rather is to emphasize them as living critical projects. They represent a critical practice of design that recognizes itself as such at the point of conception and is situated in a material urgency. They subvert the client-designer-printer/programmer paradigm, and empower commissioners as designer/agents.13 This empowering is not intended as a patronizing gesture to elevate a non-professionalized practice, but rather to call out the political dimension of graphic design while destabilizing and opening up it’s practical boundaries.

Will graphic design continue to be taught and practiced almost exclusively, as an affirmative practice of capital? Or can even political graphic design go beyond, as North claims, Foucault’s emphasis on domination and move toward what Deleuze and Guattari would call “...positive reterritorializations of unconstrained and undominated territory through creative local political action.” (p. 35, North) It seems to me that this is a task that graphic design (particularly as a non-professionalized, reterritorializ/ed/ing activity) is well poised to interrogate and execute. Perhaps in a gesture of reterritorialization, a departure from graphic design as such, towards “speculative numismatics” calls for a praxis rooted in the relationship between force (violence, power) and the signs that represent and circulate them.

Endnotes:

1 “The reversal of modern capitalism involves not only the struggle against material bondage and visible forms of repression, but also, from the outset, the creation of many alternative set-ups.” Félix Guattari (Autonomia: Post-political Politics [Los Angeles: Semiotext(e), 2007], 109)

2 http://en.wikipedia.org/wiki/Numismatics, accessed July 4th, 2011

3 I also considered “Forensic numismatics” as a marginally less pretentious candidate for the name of this genre. Although I think it would be appropriate for describing a practice that maps the operation of power through currency, it's rather less suggestive of a transformative capacity, and actually, it already describes an existing practice of grading and authenticating coin collections.

4 “Capital and state are two separate things in their modus operandi. Capital belongs to a principle of exchange, while state belongs to the principle of plunder and redistribution. Historically speaking, it was in the stage of the absolutist monarchical state that they were combined. The state necessitated the development of the capitalist economy in order to survive and strengthen itself; while the capitalist economy has had to rely on the state, because it has not been able to affect all productions to make them part of it, and what is more, it continues to be dependent even upon un-capitalized productions such as the reproduction of humans and nature. Thus, after the rise of industrial capitalism and bourgeois revolution of state, they two joined together and came to form an inseparable amalgamation, yet at the same time as sustaining their own autonomies. So it is that we have to consider counter acts against capitalism and state as one and the same movement.” (The Principles of the New Associationist Movement, Kojin Karatani, http://www.nettime.org/Lists-Archives/nettime-l-0105/msg00099.html, accessed July 12th, 2011)

5 Koine comes from Greek for shared, common, ordinary, usual, etc. The word koine, is not the etymological root of the word coin (as in money), however, the conceptual relevance presents a striking coincidence .

6 Peter North, Money and Liberation: The Micro-politics of Alternative Currency Movements (Minneapolis: University of Minnesota Press, 2007), 9.

7 David Graeber, “Debt: The First Five-Thousand Years” Mute, Vol. 2 #12, June 2009, 68.

8 David Grewal, Network Power: The Social Dynamics of Globalization, (New Haven & London: Yale University Press, 2008), 111–113.

9 We also have to ask why the state privileges or fails to challenge the punitive obligations to undemocratic usurious institutions? Why do banks, as unaccountable private institutions have such a central role in the meta-governance of nations? A group called the Central Bank of the Trans-national Republics argues that money should be considered a fourth branch of power next to the executive, judicial and legislative branches.

10 Richard J.F. Day, Gramsci is Dead: Anarchist Currents in the Newest Social Movements, (Toronto: Pluto Press; Between the Lines, 2005), 4.

11 The “Miracle of Wörgl” attracted the attention of the Austrian Central Bank who claimed an exclusive right to issue currency, and the Wörgl program was outlawed, driving the town back into severe depression.

12 See Gramsci is Dead: Anarchist Currents in the Newest Social Movements, Richard J.F. Day, 2005

13 Many designers may take issue with this because it challenges the post-fordist anxiety of designers to be recognized as authors in their own right—an anxiety for recognition that ultimately intensifies the atomization of designers making them a kind of ‘zombie’ working class subject fuelling the cybernetic machinery of advanced-capitalism.